Conexim uses a traffic light system to monitor portfolio asset allocation compliance and portfolio drift. In simple terms, when one of our clients portfolios go from Green to Amber, or from Green to Red, we contact the client (or the Advisor or Trustee responsible for their account), and propose to them a number of options.

These options are typically:

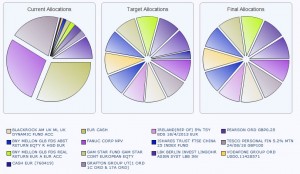

- Take Profits and Rebalance Portfolio: Where a client realises profits from a particular investment or group of investments which have performed above expectation, and reinvests the gains against the original portfolio – realigning the original asset allocation

- Cut Losses and Rebalance Portfolio: Where a client realises losses from a particular investment which have performed below expectation, and reinvests the sums against the original portfolio – again realigning the original asset allocation.

- Cut Positions and Leave in Cash: Where a client wishes to place a larger part of his portfolio in cash, in the case of uncertainty.

- Change Allocation or Individual Investments: Where a client wishes to switch funds, buy or sell equities for speculation, or to increase the allocation to a particular asset class due to a change in risk appetite or in the clients investment horizon (e.g. where a client moves closer to retirement).

- Continue to Monitor: This is where a client wishes to retain their investments even though they are outside of the initial asset allocation model. A client may do this where, for example, the equity portion of their investment is performing well above expectations, meaning their initial allocation has drifted. In such a case, we can protect the client’s downside by placing a order to sell their investments once they breach a certain level.

What makes the above possible is the extremely competitive execution commissions and handling charges via our Volume Trading Option, which allow us to rebalance investments in a portfolio at 0% for on-platform funds, and as low as 0.05% (5 basis points) for equities, ETFs and funds. With such competitive pricing, Conexim can stand over any option a client chooses when rebalancing their portfolios, as Conexim’s only incentive is to ensure the client’s portfolio matches their risk appetite, investment horizon and specific investment objectives.

If you would like a demo of our portfolio management systems, or how we manage and monitor risk in a portfolio, please feel free to contact us.