Portfolio Rebalancing

Conexim uses a traffic light system to monitor portfolio asset allocation compliance and portfolio drift. In simple terms, when one of our clients portfolios go from Green to Amber, or from Green to Red, we contact the client (or the Advisor or Trustee responsible for their account), and propose to them a number of options.

These options are typically:

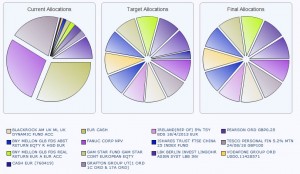

- Take Profits and Rebalance Portfolio: Where a client realises profits from a particular investment or group of investments which have performed above expectation, and reinvests the gains against the original portfolio – realigning the original asset allocation

- Cut Losses and Rebalance Portfolio: Where a client realises losses from a particular investment which have performed below expectation, and reinvests the sums against the original portfolio – again realigning the original asset allocation.

- Cut Positions and Leave in Cash: Where a client wishes to place a larger part of his portfolio in cash, in the case of uncertainty.

- Change Allocation or Individual Investments: Where a client wishes to switch funds, buy or sell equities for speculation, or to increase the allocation to a particular asset class due to a change in risk appetite or in the clients investment horizon (e.g. where a client moves closer to retirement).

- Continue to Monitor: This is where a client wishes to retain their investments even though they are outside of the initial asset allocation model. A client may do this where, for example, the equity portion of their investment is performing well above expectations, meaning their initial allocation has drifted. In such a case, we can protect the client’s downside by placing a order to sell their investments once they breach a certain level.

What makes the above possible is the extremely competitive execution commissions and handling charges via our Volume Trading Option, which allow us to rebalance investments in a portfolio at 0% for on-platform funds, and as low as 0.05% (5 basis points) for equities, ETFs and funds. With such competitive pricing, Conexim can stand over any option a client chooses when rebalancing their portfolios, as Conexim’s only incentive is to ensure the client’s portfolio matches their risk appetite, investment horizon and specific investment objectives.

If you would like a demo of our portfolio management systems, or how we manage and monitor risk in a portfolio, please feel free to contact us.

Conexim Reporting

One of the core strengths of Conexim is its reporting capability. Conexim does not believe in charging clients for reports, no matter how often clients require reports on their investments.

Conexim gives all of its clients full on-line access to their accounts. Intermediaries and Trustees can also view all of the client accounts together if they have agreed with the Clients to have access to their accounts.

Conexim can also produce scheduled or ad-hoc reports depending on the client requirements. Our standard is emailed monthly reporting, but the firm can also do it less regularly if clients do not wish to receive such regular reporting.

Conexim also provides an annual Consolidated Tax Voucher as standard to clients, and free of charge. This report details the client’s tax situation in relation to their investments on-platform.

Conexim Pricing

Conexim pricing options are generally split into two categories, depending on the expected trading profile of the client. The two options are:

- Custody and Commission Accounts for Buy and Hold clients

- Volume Trading Accounts for Active trading clients

A Custody and Commission account is suitable for Buy and Hold investors, in that the client pays a low Global Custody charge, and then pays a higher commission for each trade they enter into. Custody fees are deducted monthly so there is no lock-in for the client.

A Volume Trading account is suitable for investors with regular trading and portfolio rebalancing requirements, and gives these clients access to institutional execution rates for most asset classes, and free switching between funds. By choosing a volume option with a higher annual charge, clients can trade more regularly if they require it, and can also rebalance their portfolio multiple times per year.

Conexim believes in a straight forward and appropriate charging structure. For any clients introduced to us we do an estimation of their trading profile, and recommend the most appropriate (typically cheaper) model. Should a client’s trading profile change during the year, we will advice a client (or their advisor) that they should consider moving to the more competitive pricing model.

We also welcome prospective clients providing us with their existing portfolios which we can analyze, with a view to establishing which of our charging structures is the most appropriate. Conexim do not charge clients for cash deposits, or for products held outside of the Platform.

Typical 3rd Party TER (Total Expense Ratio) in our standard portfolios range from 0.18% to 0.42%, depending on the risk level applied in the portfolio, and the types of assets included in the portfolio. Clients and Intermediaries are however free to vary the investments from our standard portfolios, in which case the TER may vary.

Conexim always looks to calculate a TER for a client, so they can understand not only our charges, but also 3rd party fund managers.